The all-share index closed unchanged after a relatively muted session on Tuesday.

The local index shrugged off gains recorded in other global markets as global economies shift their focus towards partially reopening their economies. With global growth expected to record one of the biggest contractions since the financial crisis, investors are pinning their hopes on the early resumption of economic activity mitigating this contraction. However, there are still risks posed by this early resumption such as reinfections and wider virus spread which could induce further economic downtime. Weakness on the local bourse was primarily as a result of the resources index as miners traded mostly weaker on the day.

The rand extended its gains against the greenback as it peaked at a session high of R18.30/$ before it was recorded trading 0.97% firmer at R18.37/$ at 17.00 CAT.

GT247, South Africa's Top Online Stockbroker, as voted by Intellidex, will continue to operate their powerful MT5 trading platform during the COVID-19 lockdown period. The trading team has assembled their workstations at home and are operational remotely. Clients may experience slight delays in support queries but trading online will resume as normal. Please use our FAQ self-help portal or email supportdesk@gt247.com if you require assistance.

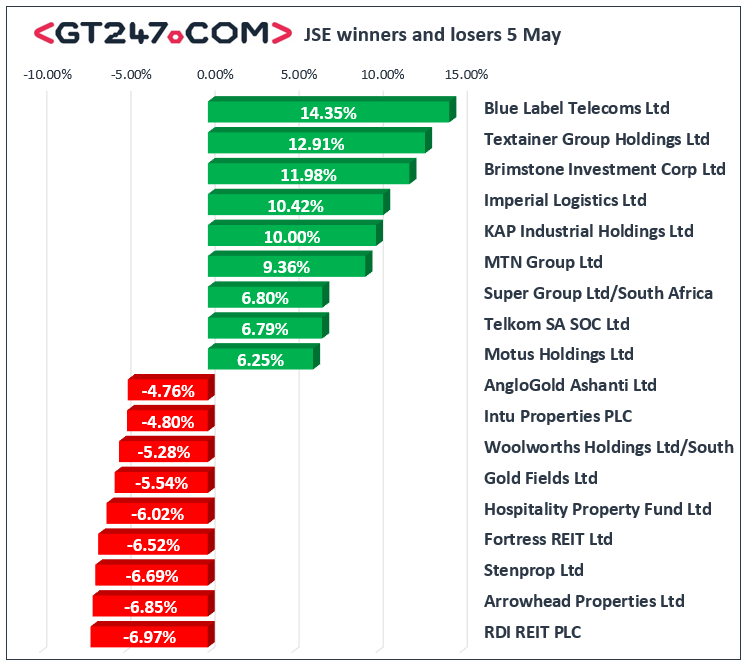

On the JSE, declines amongst in the resources index were led by Gold Fields [JSE:GFI] which fell 5.54% to close at R141.81, AngloGold Ashanti [JSE:ANG] which lost 4.76% to close at R455.09, as well as Sibanye Stillwater [JSE:SSW] which dropped 4.71% to close at R35.64. Northam Platinum [JSE:NHM] lost 4.33% to close at R85.05, while Pan African Resources [JSE:PAN] fell 2.08% to close at R3.30. Listed property stocks had a tough outing as declines were recorded for RDI REIT [JSE:RPL] which lost 6.97% to close at R12.82, Fortress REIT [JSE:FFB] which fell 6.52% to close at R2.15, while Hammerson PLC [JSE:HMN] which closed at R13.57 after falling 4.57%. Declines were also recorded for rand hedge Mondi PLC [JSE:MNP] which fell 3.52% to close at R305.79, and for retailer Woolworths [JSE:WHL] which dropped 5.28% to close at R28.37.

Blue Label Telecoms [JSE:BLU] was one of the day’s biggest movers after it surged 14.35% to close at R2.55, while sector peer MTN Group [JSE:MTN] climbed 9.36% to close at R50.80. Imperial Logistics [JSE:IPL] rallied 10.42% to close at R37.51, while Motus Holdings [JSE:MTH] added 6.25% to close at R29.75. Financials advanced on the back of the firmer rand which saw gains being recorded for Standard Bank [JSE:SBK] which gained 4.22% to close at R99.45, and for Investec Ltd [JSE:INL] which gained 2.04% to close at R37.53. Gains were also recorded for Aspen Pharmacare [JSE:APN] which surged 5.19% to close at R126.01, and for Remgro [JSE:REM] which closed at R138.00 after adding 4.4%.

The JSE All-Share index was unchanged at the end of the session while the JSE Top-40 index shed 0.1%. The Resources index lost 1.74% however, the Industrials and Financials index gained 0.39% and 2.31% respectively.

Brent crude recorded another surge in today’s surge as it was recorded 9.56% higher at $29.80/barrel just after the JSE close.

At 17.00 CAT, Platinum was 0.03% firmer at $768.97/Oz, Gold was 0.22% softer at $1698.10/Oz, and Palladium had slipped 4.45% to trade at $1779.12/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.