The all-share index eventually closed weaker on Tuesday following a mixed session in which the local bourse swung between gains and losses.

Most global markets remained in the red due to the negative sentiment which carried over from Monday’s slump. With fears over the spread coronavirus still rife, there is a tentative approach for riskier assets such as stocks. The Japanese Nikkei resumed trading today and tumbled 3.34%, while the Shanghai Composite Index lost a more modest 0.22%. The Hang Seng inched up 0.27%. Losses were recorded across all the major European bourses however the losses were more modest in comparison to the prior session.

Locally, market participants shift their attention to South Africa’s budget speech which is slated for Wednesday at 14.00 CAT. Of more significance will be how Moody’s Investors Services rates South Africa’s sovereign rating given that it recently downgraded its GDP forecast.

The rand is still trading softer due to the stronger US dollar, and in today’s session it slipped to a session low of R15.24/$. At 17.00 CAT, the rand was trading 0.41% softer at R15.19.

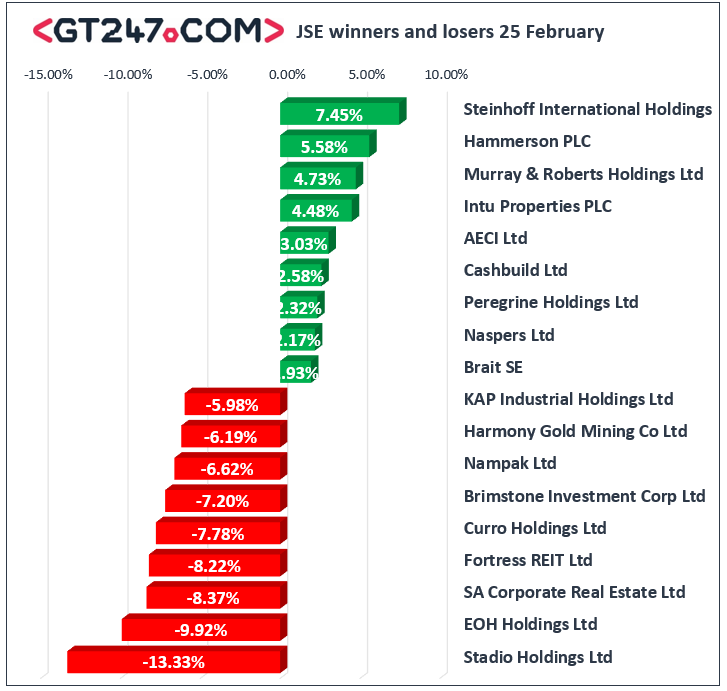

On the JSE, Curro Holdings [JSE:COH] tumbled following the release of its full-year results which showed a decline in earnings. Stadio Holdings [JSE:SDO] also came under significant pressure as it lost 13.33% to close at R1.56. The share closed 7.78% to close at R12.45. SA Corporate Real Estate [JSE:SAC] fell 8.37% to close at R2.08, while Fortress REIT [JSE:FFB] lost 8.22% to end the day at R5.25. Sibanye Stillwater [JSE:SSW] fell as low as R37.51 before it settled 5.67% lower at R39.60. Packaging specialist Nampak [JSE:NPK] dropped 6.62% to close at R4.23, while KAP Industrial Holdings [JSE:KAP] fell 5.98% to close at R3.30. Shoprite [JSE:SHP] had a volatile session which saw the share reach a session high of R117.00 before it fell to close 2.17% lower at R103.60. Losses were also recorded for index heavyweights such as Vodacom [JSE:VOD] which dropped 1.28% to close at R114.64, and Reinet Investments [JSE:RNI] which closed at R330.72 after losing 1.13%.

Steinhoff International [JSE:SNH] close amongst the day’s biggest gainers after the share surged 7.45% to close at R1.73. UK focused listed property firm, Hammerson PLC [JSE:HMN] rose 5.58% to close at R44.85, while its sector peer Intu Properties [JSE:ITU] added 4.48% to close at R2.80. Index giant Naspers [JSE:NPN] gained 2.17% to close at R2606.96, while diversified miner Anglo American PLC [JSE:AGL] rose 1.75% to close at R387.14. Kumba Iron Ore [JSE:KIO] managed to post gains of 0.95% to close at R331.12, while Richemont [JSE:CFR] gained a modest 0.49% to close at R108.01.

Thanks to gains in some of the index giants the JSE Top-40 index eked out gains of 0.04%, however the broader JSE All-Share index shed 0.13%. The Industrials index managed to post gains of 0.45%, but the Financials and Resources indices retreated 1.08% and 0.27% respectively.

Brent crude traded mostly flat on the day and it was recorded trading 0.38% softer at $55.56/barrel just after the JSE close.

At 17.00 CAT, Palladium was up 2.33% at $2689.32/Oz, Platinum was down 0.85% at $955.12/Oz, and Gold was 0.62% softer at $1651.53/Oz.

Disclaimer:

Any opinions, news, research, reports, analyses, prices, or other information contained within this research is provided by GT247.com at GT247 (Pty) Ltd t/a GT247.com (“GT247.com”) as general market commentary, and does not constitute investment advice for the purposes of the Financial Advisory and Intermediary Services Act, 2002. GT247.com does not warrant the correctness, accuracy, timeliness, reliability or completeness of any information which we receive from third party data providers. You must rely solely upon your own judgment in all aspects of your trading decisions and all trades are made at your own risk. GT247.com and any of its employees will not accept any liability for any direct or indirect loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from use of or reliance on the market commentary. The content contained within is subject to change at any time without notice.