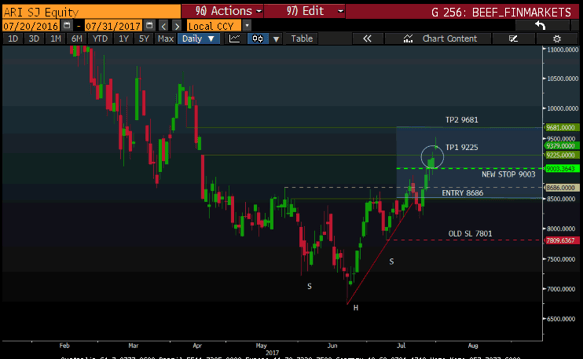

Trade Update - [JSE:ARI]

01/08/2017

Another target hits and AFRICAN RAINBOW MINERAL LIMITED (ARI) has been flying since the 25th of June with the first target price reached on Friday 28 June at 9225c. We saw the price moving even higher yesterday and well on its way to the second target price at 9681c.

I have moved my stop higher to lock in those profits at 9003c and will be looking at AFRICAN RAINBOW MINERAL LIMITED (ARI) closely over the coming days.

The TRADE:

Direction: Buy (long)

Entry: 8650c

New Stop: Loss: 9003c

Target Price 1: 9225c (Reached)

Target Price 2: 9681c

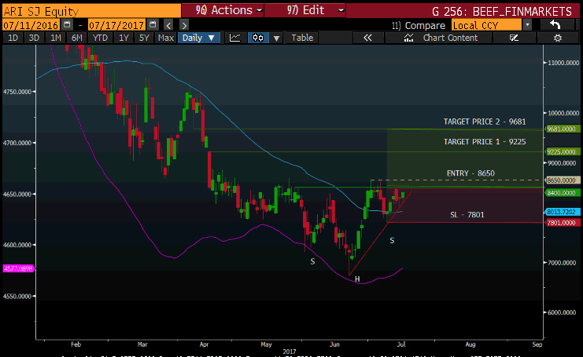

African Rainbow Minerals Ltd [JSE:ARI]

19/07/2017

Direction: Buy (long)

Entry: 8650c

Stop: Loss: 7801c

Target Price 1: 9225c

Target Price 2: 9681c

Indicators: 200 MA (purple) and 50 MA (blue)

Today I will be looking at buying African Rainbow Minerals Limited (ARI) at 8650c. An inverse head and shoulders has formed which gives me confirmation to buy this stock but the price must break the neckline which is crucial at this stage. The stop loss is placed below the right shoulder at 7801c make sure that this is within your risk management rules.

Also, the price has been bouncing off the 200-day moving average (purple line) as well as the 50-day moving average (blue line) and both lines are pointing up which is also giving a positive signal. The price action is also starting to make higher lows which is also good confirmation of the price moving higher. Target price 1 is around 9225c with target price 2 around 9681.

Chart Source - Bloomberg

Always remember to apply your risk management measures before placing your trades as this will keep you trading in the markets.

Disclaimer: Any opinions, news, research, analyses, prices, or other information contained within this research is provided as general market commentary, and does not constitute investment advice. GT247.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information. The content contained within is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions.

GT247.com: +27 87 940 6101

IT support & help desk: +27 87 940 6107

Client relations (new accounts): +27 87 940 6106

Sales: +27 87 940 6108