Trading Education

How to use Divergence

Divergence is just one of the many Technical Analysis tools that traders use to determine whether the price action/ momentum in an instrument is about to change direction and this is certainly something I consider when placing trades.

In this piece i will explain what divergence is and how you can use it your advantage.

What is Divergence?

To put it simply, divergence is when the price of an asset and your Oscillating indicator move in the opposite directions. The Oscillating indicators to use are the moving average convergence divergence (MACD), price rate of change (ROC) or the relative strength index (RSI).

There are two types of Divergence:

Positive Divergence:

This is when the price of an instrument is heading in a down trend and your oscillating indicator is heading in an upward direction.

Negative Divergence:

This is simply when the opposite will happen to positive divergence, so negative divergence is when the price moves in an uptrend and your oscillating indicator heads downwards.

Divergence in action:

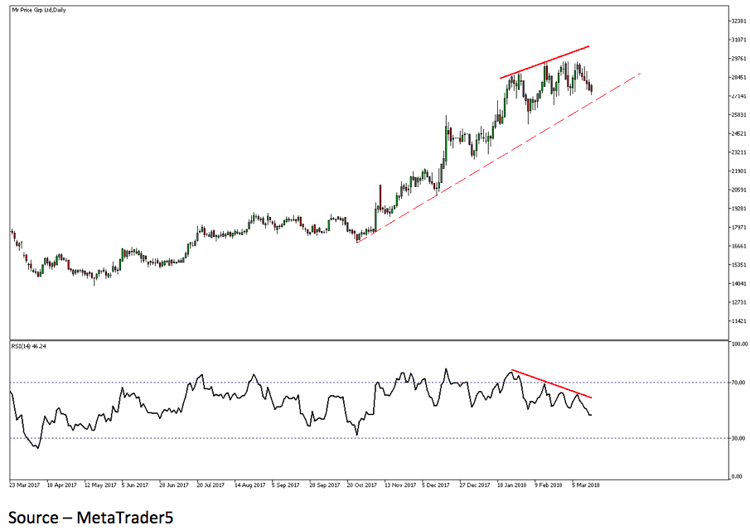

In the chart below, you have an example of negative divergence shown by the red lines on the price and RSI indicator. Price is moving higher and your indicator is moving lower.

How to apply Divergence:

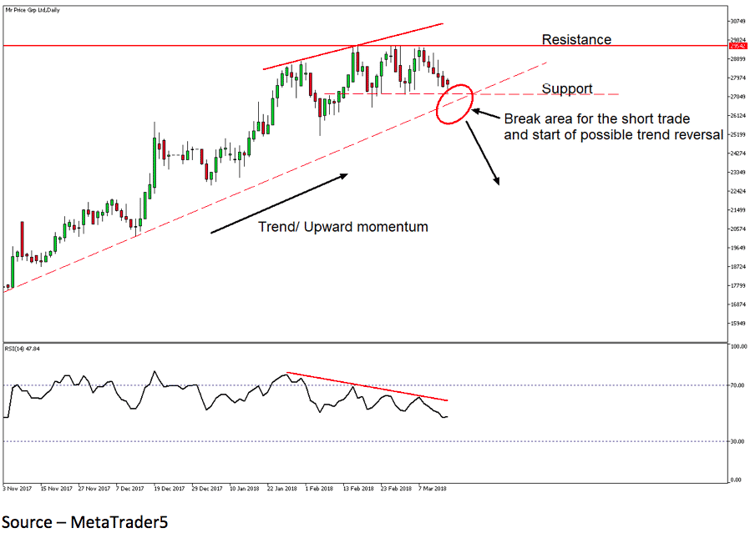

When looking for divergence use tools such as trendlines, support and resistance levels to help confirm the reversal as part of your technical analysis before placing your trade.

Always keep your risk management measures in check and never enter a trade prematurely as there is no full proof method in trading and anything can happen and usually does happen.